Total Assets Turnover Ratio is calculated using the formula given below What is the Total Assets Turnover Ratio?Īverage Total Assets is calculated using the formula given below.Īverage Total Assets = (Opening Total Assets + Closing Total Assets) / 2 The given values are Net Sales for the year = $ 15,000, Total assets at the beginning of the year = $ 11,500 and Total assets at the end of the year = $ 12,000. Let us take an example to calculate the Total Assets Turnover Ratio.

It shows that sales and, specifically, credit sales are 20 times the accounts receivable outstanding, which is a good turnover to have, but it should be compared to previous year’s data as well as other players in the industry to have a complete analysis. Accounts Receivable Turnover Ratio = 20 times.Accounts Receivable Turnover Ratio = 60,000/ 3,000.Average Accounts Receivables = 2,500 + 3,500 / 2Īccounts Receivable Turnover Ratio is calculated using the formula given below.Īccounts Receivable Turnover Ratio = Credit Sales / Average Accounts Receivables.What are the Accounts receivable turnover ratio of the company?Īverage Accounts Receivables is calculated using the formula given below.Īverage Accounts Receivables = Opening + Closing / 2 At the beginning of the financial year, Accounts Receivables were $ 2,500, and at the end, accounts receivables were $ 3,500. Let us take another example of a company which is having net credit sales worth $ 60,000 during one financial year. Working Capital Turnover Ratio of six times shows that sales in 6 times that of employed assets of working capital should be compared to the previous year’s data as well as other players in the industry to get a better sense. Working Capital Turnover Ratio = 6 Times.Working Capital Turnover Ratio = 15,000 / 2,500.Working Capital Turnover Ratio = Net Sales / Working Capital Working Capital Turnover Ratio is calculated using the formula given below. Working Capital = Current Assets – Current Liabilities Working Capital is calculated using the formula given below What is the Working Capital Turnover ratio of the company? Whose revenue from operations or net sales for a period is $ 15,000, and its current assets and current liabilities for the period are $ 10,000 and $ 7,500, respectively. Let us take another example of a company Mobility Inc.

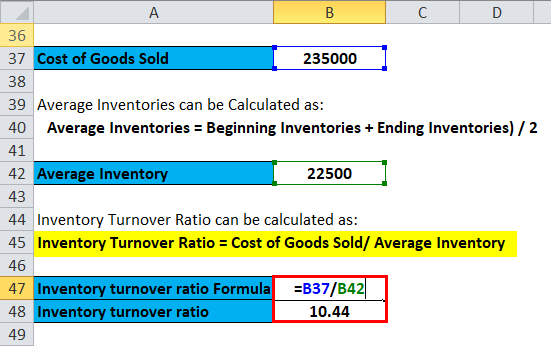

It shows that the inventory turnover ratio is 3 times, and it should be compared to the previous year’s data as well as other players in the industry to get a better sense. Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory Inventory Turnover Ratio is calculated using the formula given below

0 kommentar(er)

0 kommentar(er)